rarrarorro

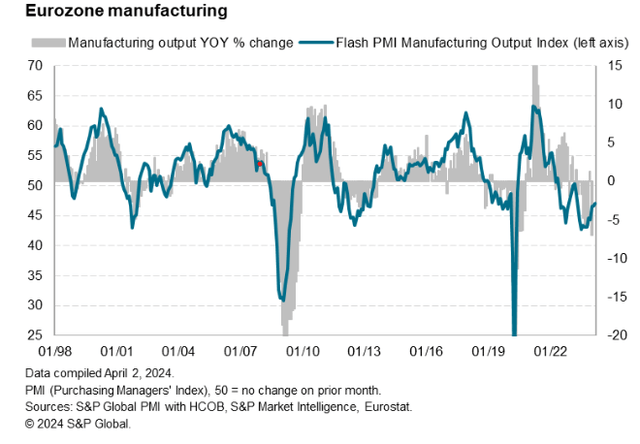

Eurozone manufacturing output has contracted in all bar two of the past 22 months, according to the PMI® survey data compiled by S&P Global. The data follow official statistics showing production in January was some 7.0% lower than a year ago. With the exception of the pandemic lockdowns, this represented the steepest annual rate of decline since 2009.

But leading indicators hint at production stabilising and potentially returning to growth in the near future. In fact, production has already returned to growth outside of France and Germany, helping the downturn moderate in March to its slowest for nearly a year.

Factory downturn moderates

The HCOB Eurozone Manufacturing PMI®, compiled by S&P Global, signalled a twelfth successive monthly fall in factory output in March, and the twentieth fall in the past 22 months. However, the rate of contraction moderated to an 11-month low, raising the prospect of the sector soon stabilising.

Such a prospect was given additional weight by three other key leading indicators.

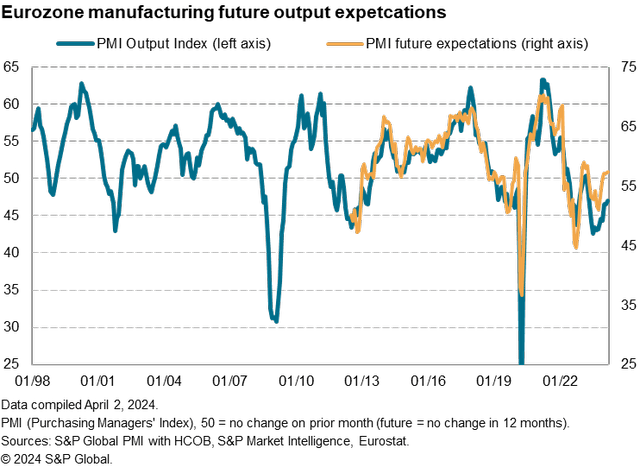

Future output expectations at 11-month high

First, as well as asking respondents to report on current production trends, companies participating in the PMI surveys are also asked how they expect their own output to change over the course of the next year. These responses are converted into an index where 50 signals no expected change, with readings above 50 signalling an anticipated expansion of production over the coming year and readings below 50 signaling an expected decline. March saw this Future Expectations Index rise to its highest since April of last year, improving further from the recent low seen in October of last year. Although by no means pointing to a strong rise in production in the near term, the improved output expectations at least add to signs that the downturn should continue to moderate in the coming months.

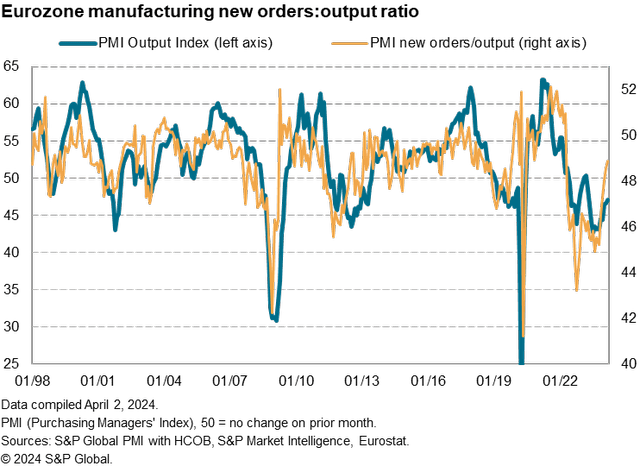

Orders-output ratio at 23-month high

Second, although new orders continued to fall in March, the decline was the smallest recorded for a year. When compared to the production trend, the easing in the rate of order book decline also bodes well for production to stabilise in the months ahead. The orders-output ratio – a leading indicator of the production trend – rose in March to its highest for just under two years.

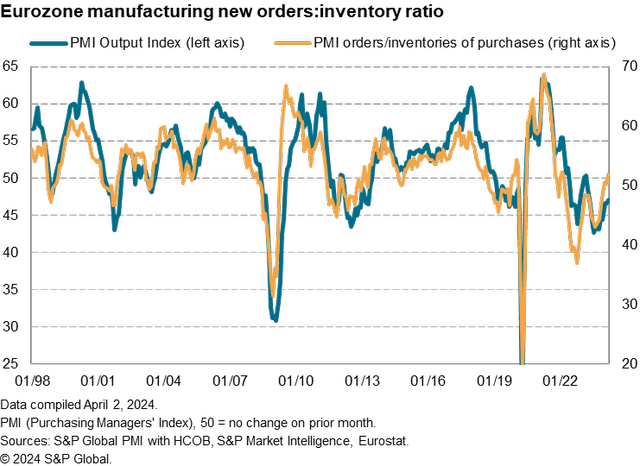

Orders-inventory ratio highest for over two years

A third encouraging indication comes from the orders-inventory ratio, which hit a 21-month high in March. While new orders fell at a reduced rate in March, inventories of materials fell at an increased pace, a situation which typically leads to greater purchasing of inputs, including semi-manufactured goods, as firms restock warehouses.

Signs of renewed growth outside of France and Germany

One further encouraging sign from the surveys was seen in terms of the national breakdown of the data. March saw manufacturing output return to growth in the Netherlands and Italy, both joining Greece and Spain in expansion territory.

Thus, although France and Germany remained in contraction, the rest of the region has now already collectively seen output rise – albeit marginally – for two successive months. France’s production downturn meanwhile eased to register the smallest decline for 22 months, moving closer to stabilsation. That left Germany as the main drag on output in the region, where output continued to fall at a steep pace in March. However, even here the rate of decline moderated slightly in March.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

from Finance – My Blog https://ift.tt/aOUxVsj

via IFTTT

No comments:

Post a Comment