Nilang Kachare

The 1995-like bullish thesis

The inventory market bulls argue that the present setting is much like the setting in 1995, which is when the dot.com bubble began to kind, and continued to inflate till March 2000.

The bullish thesis is that the present AI-bubble is equally in a really early stage, with probably years to go till the burst.

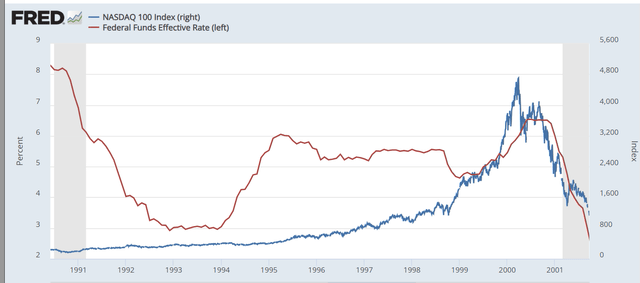

The parallel with 1995 relies on the Fed’s coverage path. The Fed was eradicating straightforward financial situations after the 1991 recession, and climbing rates of interest in 1994. Nonetheless, the Fed was in a position to pause the hikes and lower rates of interest in 1995 – with out inflicting a recession. The “soft-landing” or no-landing” end result of the Fed’s tightening cycle triggered a serious uptrend within the inventory market.

The chart under reveals the Fed’s coverage path (pink line) and Nasdaq 100 (QQQ) (blue line).

FRED

Equally to 1995, the market is presently predicting a soft-landing or no-landing end result of the Fed’s latest climbing cycle, and consequently, the AI-fueled longer-term rally in shares.

However, let us take a look at the macro setting through the Nineties.

The goldilocks of Nineties

- The geopolitical context.

The U.S. entered the Nineties as the last word geopolitical winner with the collapse of the Soviet Union. The Nineties began the development of privatization within the rising markets, and accelerated globalization – all underneath full management of the U.S.

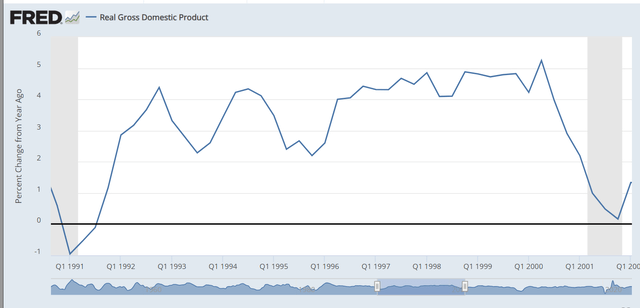

- The actual financial progress.

After a shallow 1991 recession, the U.S. actual GDP spiked to over 4%, which is what triggered the Fed’s financial coverage tightening. After a short slowdown to 2.5%, GDP roared again to 4-5% annual progress charge for the remainder of the Nineties. The purpose is – the U.S. actual GDP progress was very sturdy through the Nineties.

Actual GDP (FRED)

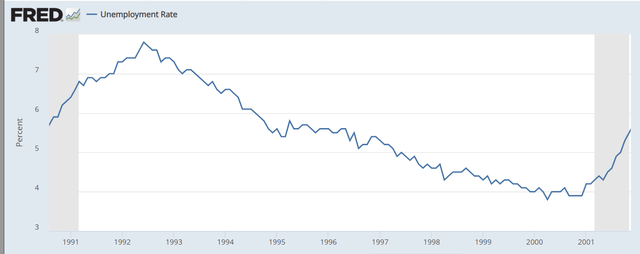

The unemployment charge was over 7% after the 1991 recession, but it surely stored regularly falling all through the Nineties, down to three.8% by the yr 2000.

Unemployment charge (FRED)

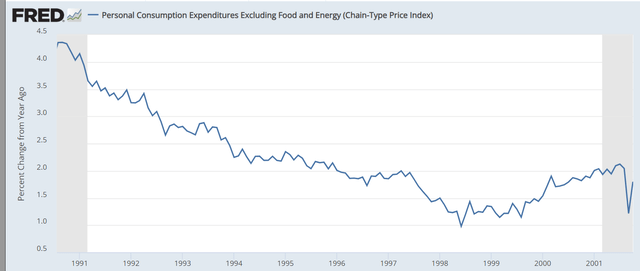

Inflation, as measured by core PCE (Fed’s most well-liked measure), was above 4% getting into the Nineties. Nonetheless, it reached the two% stage in 1994/1995 and stored regularly falling all through the Nineties, dipping to 1% in 1998, after which regularly rising to 2%. The purpose is, rising inflation was low and by no means an issue after 1995.

Core PCE (FRED)

What was the Fed involved about through the Nineties?

The Nineties had an ideal macro setting.

- The geopolitical scenario was good and supportive of high-growth and low inflation.

- The GDP progress was booming, with elevated exports, manufacturing, and consumptions.

- The employment scenario was good, with falling unemployment, however not too low to set off inflationary pressures – till the tip in 2000 (when issues modified).

- Thus, the inflationary scenario was good – low and steady inflation, supported by globalization.

So, what was the Fed involved about through the Nineties? Listed here are the important thing FOMC statements through the interval.

- The final hike in 1995 – The “moderation in progress” assertion signaled the pause. The Fed had been involved in regards to the sturdy progress and rising sources utilization (falling unemployment charge and rising capability utilization). However inflation by no means actually spiked. This triggered the start of the dot.com bubble.

FOMC

- The primary lower in 1995 – the start of normalization: “inflationary pressures have receded sufficient to accommodate a modest adjustment in financial situations.” Inflation was by no means an issue, regardless of very sturdy progress.

FOMC

- The Fed elevated rates of interest in 1997, quoting “persistent energy in demand” that means sturdy financial progress, however nonetheless inflation remained low.

- The Fed lower rates of interest in 1998 because of the rising markets monetary disaster, which boosted the speculative dot.com mania as US progress remained sturdy with very low inflation.

- The primary hawkish hike in 1999 and the start of the tip – reference to the “tight labor market”(unemployment charge was already under 4%), and “ongoing energy in economic system in extra of productiveness positive aspects.”

FOMC

- A number of dovish flip-flops – The Fed said over a number of conferences in 1999 that “productiveness positive aspects may comprise inflation, and even paused because of the Y2K points.

- The February 2000 hawkish pivot and the burst of the dot.com bubble – the Fed lastly determined to burst the bubble and said, “the dangers are weighted primarily towards situations which will generate heightened inflation pressures within the foreseeable future.”

FOMC

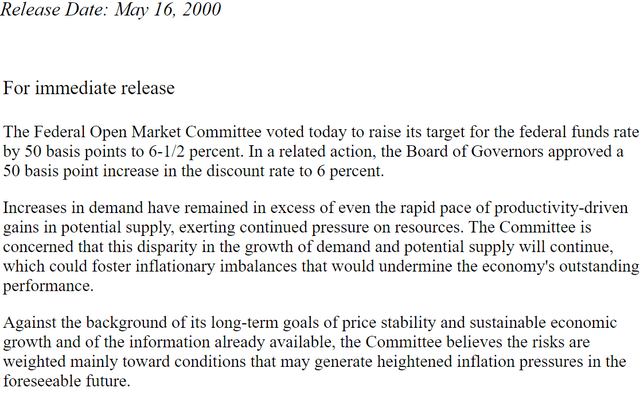

- The final hike in Could 2000 – 50bpt hike – nonetheless involved in regards to the “will increase in demand in extra of even the speedy tempo of productivity-driven positive aspects in potential provide.” The unemployment charge was 3.8% however core PCE inflation was nonetheless under 2%!

FOMC

- The Finish – The December 2020 recessionary warning and the sign of financial easing – “the dangers are weighted primarily towards situations which will generate financial weak spot within the foreseeable future.” References to “eroding client confidence” and “shortfall in gross sales and income.”

FOMC

The Fed was primarily proactive through the Nineties, viewing sturdy financial progress as an inflationary danger, but it surely turned severely involved about inflation solely when the unemployment charge dropped to three.8% in 1999/2000.

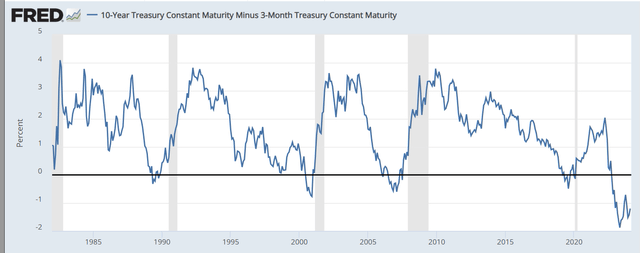

The primary factor to think about is that the Fed by no means inverted the yield curve in 1994-1995, because the graph under reveals. Thus, the Fed didn’t see the necessity to induce a recession to manage inflation.

The Fed inverted the yield curve in 2000, and that induced the recession and the burst of the dot.com bubble.

FRED

How is that this much like the present scenario?

Let’s begin with the geopolitical context. The world is in technique of deglobalization with the emergence of bipolar governance. That is the return to the Chilly Warfare setting of the Nineteen Seventies, and an entire reversal of the Nineties scenario.

Thus, the present macro setting favors increased inflation and decrease progress – attributable to deglobalization. Once more, this can be a full reversal of the Nineties.

At the moment the U.S. progress is robust, nonetheless attributable to post-pandemic spending, and likewise authorities spending. But, no person expects 4-5% annual progress over the subsequent 5 years. Different main world economies are presently in a recession or borderline recession.

Extra importantly, through the Nineties, the U.S. authorities reached a finances surplus, now it is dealing with an unsustainable improve in debt and deficit – and that is placing extra strain on inflation as nicely.

Particularly, with respect to the 1995-bubllish thesis – the yield curve is now deeply inverted, and it was not inverted in 1995 – but it surely was inverted in 2000. Thus, the present scenario extra resembles 2000, particularly provided that the unemployment charge is at an identical stage of three.7/3/8%.

Implications

The AI bubble is presently in a full upswing, largely led by Nvidia (NVDA) Nonetheless, based mostly on the macroenvironment, the present scenario extra resembles 2000 than 1995, which means that the AI bubble is close to its peak.

The bubble will seemingly burst with the Fed’s hawkish flip, like in March of 2000. The Fed had a number of dovish flip-flops in 1999, and equally it is presently in a dovish mode. However given the rising inflationary pressures, it is seemingly that the hawkish pivot is close to – and with it the bust of the AI bubble.

The broad market index S&P500 (SP500) is now closely concentrated within the large tech, and Nvidia is the third largest inventory within the Index. Thus, the index traders are weak to a deep selloff corresponding to the 2000-2003 bear market. On condition that the bubble continues to be on the upswing, my suggestion continues to be Maintain, with the give attention to the March FOMC assembly for a possible hawkish pivot.

from Finance – My Blog https://ift.tt/4wHnMWP

via IFTTT

No comments:

Post a Comment