nielubieklonu

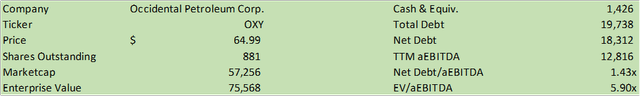

Occidental Petroleum (NYSE:OXY) is making strides in positioning itself for strength as a carbon-friendly oil producer as the firm further develops its full-cycle well enhancements through CO2 direct air capture and EOR for well enhancements. As the oil industry faces a flat-to-down oil market for eFY24 paired with easing inflationary pressures relating to production, I believe Oxy is well-positioned for optimizing well production through CO2 injection as well as its asset-clustering strategy. I believe that through their planned deleveraging program, anticipated acquisition of CrownRock followed by reinstating their share buyback program, and their enhanced oil recovery program, Oxy will be a strong turnaround and growth investment for years to come. I provide OXY shares a BUY recommendation with a price target of $90.10/share at 6.08x eFY25 EV/aEBITDA.

Operations

Oxy, like many IOCs, is positioning itself to effectively wade through the expected flat-to-down oil market for eFY24 by focusing production on longer-cycled assets. In their q4’23 earnings call, management discerned that they will be focusing on bolstering moving to add a second drillship in the Gulf of Mexico to further develop their offshore assets. As WTI presently sits above $80/bbl, I believe that this long-cycled strategy will ease some of the capital intensity as seen in short-cycled unconventional production. Management forecasted a decrease in capital investments of $320mm for short-cycle and exploration for eFY24 with an increase to the capital budget for mid-cycle investments of $480mm. With their balanced portfolio, management anticipates that the production split will be 65/35 shale/offshore once the CrownRock acquisition closes in e2h24.

Oxy has spent much of the last 3 years bolstering its assets to enhance its long-term strategy. As of FY23, the firm has nearly doubled its proved undeveloped reserves since 2020 to 1,232MMboe with proved developed reserves increasing to 2,750MMboe for total proved reserves of 4Bboe. I believe that through their strategic acquisitions, Oxy is playing to bolster their valuation on a reserves basis while remaining disciplined in production growth. For eFY24, management anticipates growing total production by 2%. This strategy should benefit Oxy in the long run as the firm manages and top-grades its assets for a better pricing environment. This can be seen through the firm’s all-in reserve replacement of 137% for FY23. Management anticipates investing $5.8-6b across their energy and chemicals businesses in eFY24 with a focus on medium-cycled assets. In addition to this, Oxy plans to invest an additional $600mm into its low-carbon ventures and will potentially receive additional investments from BlackRock.

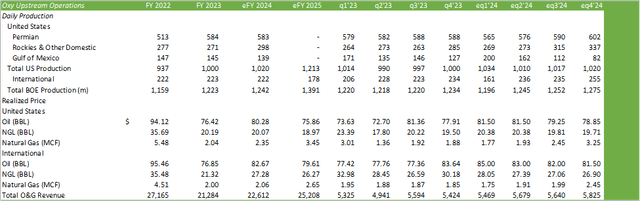

Oxy experienced production strength in their Rockies and DJ Basin assets while holding their Permian production steady in q4’23. The Rockies and their assets in Al Hosn will be the primary focus for production growth in eFY24 as the firm assuages their tier 1 assets in the Permian. I believe that Oxy’s plan to focus on lower-tier wells may create some near-term margin headwinds; however, this strategy will preserve the firm’s higher-tier assets for stronger oil markets when production strength can better be realized.

In the Permian Basin, management anticipates maintained production rates as they navigate the current oil price cycle. Oxy is currently working to increase gas processing capacity with a new facility in the Permian Basin along with implementing their EOR and direct air capture investments. Management alluded to the fact that EOR and direct air capture will likely be realized in operations in 2026 as they anticipate placing the DAC facility into operations in mid-2025.

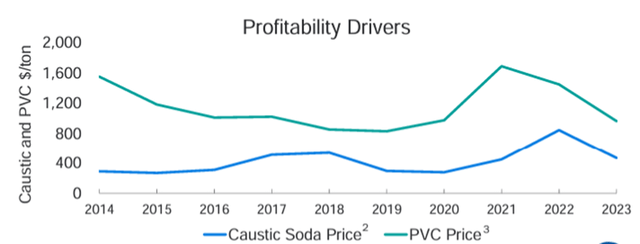

On the chemicals side of the business, management anticipates some near-term headwinds for PVC and caustic as the pricing pressures from China remain unfavorable. Management anticipates OxyChem to generate between $1-1.2b in EBT for eFY24. Management forecasts investing $700mm into the chemicals business for Battleground expansion and plant enhancement projects. Management anticipates construction of the Battleground facility to be completed by mid-2026. Once completed, the combined EBITDA impact from the new facility and the plant enhancement project will add an additional $300-400mm annually.

Oxy Investor Presentation

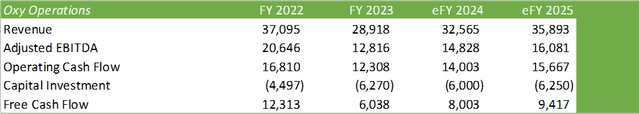

Forecasting out financials, Oxy faces a relatively flat-to-down market in the O&G space as the global economy teeters between growth and recession.

Corporate Reports

Using the strip price published by the CME as a guide, I anticipate oil prices to average in the high-70s to low-80s for eFY24 and fall back to around $75/bbl in eFY25. I also anticipate natural gas prices to recover modestly in the coming years as domestic dry gas production stagnates. I do believe Oxy will continue ramping up production to meet the growing oil demand. Do note my forecast for eFY25 includes the additional 170Mbbl/d resulting from the CrownRock acquisition.

Corporate Reports

For eFY24, I do anticipate some margin expansion as management guided lower per barrel opex for the coming fiscal year; however, I do anticipate slight y/y margin compression going into eFY25 with the expectation of increased drilling activity and higher midstream costs.

Despite my bullish tone, there may be certain risks to the downside worth considering. Oxy’s full-cycle CCUS project is still years out and may not yield the expected recovery rate. Management also anticipates additional funding from BlackRock for their second DAC facility in Texas. BlackRock has been backpedaling away from the ESG label and has since collapsed its ESG mutual funds. As more states combat ESG-oriented investing, gathering outside funding may not be as simple as it once was.

Valuation & Shareholder Value

Corporate Reports

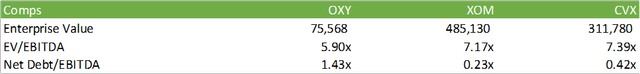

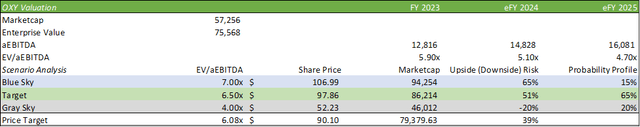

OXY shares currently trade at a slight discount to its IOC peers at 5.90x EV/aEBITDA. I believe that with the firm’s direction towards CCUS, OXY shares hold a lot of hidden value to be unlocked. I believe that the firm needs to take some steps to deleverage the balance sheet prior to achieving a higher share premium as the firm’s net debt far surpasses its peer domestic IOCs at 1.43x net debt/aEBITDA.

Corporate Reports

I do believe that the firm will have the capital flexibility to do such, especially as management cuts the share repurchase program until post-CrownRock closing. This should free up some additional capital to pay down debt while maintaining their increased dividend rate of $0.88/share. Considering multiple scenarios for OXY, I believe that shares can experience some margin expansion in the coming years as the firm cleans up its capital structure and moves forward toward decarbonizing the oil production process. I value OXY shares at $90.10/share at 6.08x eFY25 EV/aEBITDA and provide a BUY recommendation.

Corporate Reports

I believe that for OXY shares to reach the blue-sky scenario, oil prices will need to climb to the upper-$80-90/bbl range, which very well could happen as OPEC+ maintains their production cuts paired with increasing demand forecasts. The target scenario prices oil with the current strip price. The gray-sky scenario would suggest more pricing headwinds, pricing oil in the low-$70s.

from Finance – My Blog https://ift.tt/QhBe2SV

via IFTTT

No comments:

Post a Comment