Aaron Davidson

Introduction

Celsius Holdings (NASDAQ:CELH) is probably one of the hottest stocks on the market right now, which is unique for a company selling energy drinks. Celsius has been able to propel itself to the top through its strong brand affinity and distribution deals with large companies like PepsiCo (PEP) over the last few years.

In addition, the company is very popular with the younger generation, partially due to its brand ambassador program focusing on a healthy lifestyle, which we can only applaud with obesity rates increasing year over year.

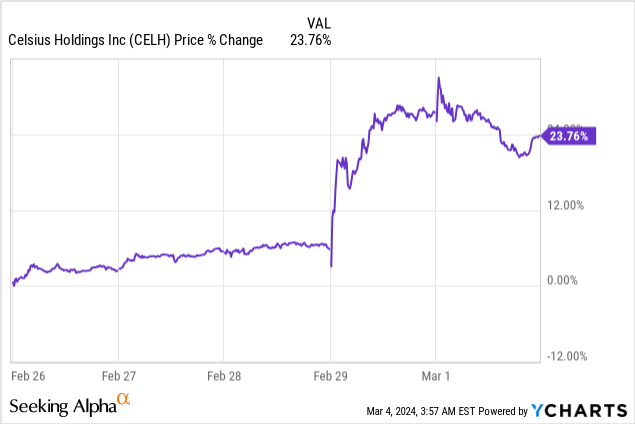

The stock jumped after it released its earnings after hours on February 28th as revenue increased to $347M, up close to 95% Y/Y, beating by $15.55M. GAAP EPS came in at $0.17, a slight miss of $0.01 but still remarkably profitable for a company growing that fast. The outstanding growth caused the stock to move higher in the following day.

The stock was up 23.76% in the days following its earnings.

Ycharts

Over the last year, Celsius’ stock has more than tripled.

Finchat

The Financials

Now, let’s take a look at the numbers!

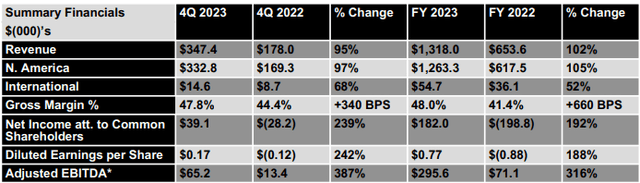

Let’s start by taking a look at some of the key figures. The $347M in revenue is another quarterly record. The increase in revenue is mainly driven by North American revenue, which increased 97% year-over-year, reaching $333M.

This means that 96% of Celsius’ revenue comes from North America, which shows that Celsius has plenty of room to expand abroad if they believe it is the time to do so.

This increase in revenue was driven by higher SKUs (an SKU is a Stock Keeping Unit, which is a term used to identify unique products in its product range). In addition to higher SKUs, there were also more distribution points, which positively impacted the revenues, as mentioned during the earnings call.

International revenue increased 68% year-over-year to $14.6M, mainly driven by new flavor launches, product availability, and increased velocity. Something I personally really liked to see is the 3.4% increase in gross margin, this shows that Celsius is further gaining pricing power and that it isn’t affecting growth.

Celsius Q4 Press Release

Celsius made it clear that they will continue to drive growth by focusing on three main areas, which they mentioned during the earnings call.

- Increasing total distribution points

- Growing in non-tracked channels

- International expansion

This is only reasonable, but we have to keep in mind that the international expansion is a long-term plan. Important to take into consideration that the European market is different than the U.S. market. As such, it remains to be seen how well Celsius will do in other parts of the world.

The energy drink market remains a tough space with competitors like Monster (MNST) and Red Bull. This means that distribution will be key for further growth and Celsius did an excellent job during 2023.

In 2023, Celsius achieved nearly complete distribution coverage in the United States topping 98% ACV which is a major achievement. Celsius has been able to put their products in reach of more consumers and more consumption occasions with greater flavors and size options than ever before.

Furthermore, Celsius is now fully integrated into PepsiCo’s (PEP) annual planning cycle, and Celsius expects to continue collaborating closely with its main distribution partner and expanded key accounts team.

An important achievement in 2023 was that Celsius was the number one energy drink on Amazon (AMZN) during 2023. Furthermore, they also got recognition from industry partners, including the 7-Eleven’s Supplier of the Year award, which is an incredible achievement. This is something that shows Celsius is effectively executing its strategy.

Sales and marketing as a percentage of revenue was 20% over the last 12 months, this is down from 24% in 2022. Not that they slowed down on marketing, they mentioned they will continue to invest in growth and in the brand itself.

Celsius’ indicated that they want to move to “the next level” and the next target is to get beyond 10% market share. CFO Jarrod Langhans said the following regarding this during the earnings call:

We will need to continue to invest in our growth and our brand, as seen with the multiple Super Bowl activations that we did in February, our recently announced multiyear partnership with Ferrari within Formula One as well as our multiyear MLS partnership.

This shows Celsius’ ambition to be in front of the customer and its efforts to rapidly expand its market share.

When we look further at G&A as a percentage of revenue we can see this is also trending down, which is a good sign. CEO John Fieldly had the following to say regarding G&A:

G&A expense as a percentage of sales was 8% for the 12 months of 2023 versus 12% in the prior year same period. We will continue to invest in our back shop and build out a team that is value-added to operations, sales, and marketing programs. There will be opportunity to further leverage G&A in 2024 and beyond, but it will be at a thoughtful and methodical pace.

Celsius Investor Presentation

Regarding the international expansion, CEO John Fieldly had the following to say.

We began distribution in sales in Canada through Pepsi in mid-January. As we had previously signaled, after approximately 1 month of sales, we are very pleased with the results and even more so to delight our Canadian consumers who have embraced our products. International sales reached $14.6 million in the fourth quarter of 2023 and $54.7 million for the full year.

Also in January, we announced a sales and distribution agreement with Suntory Beverage for Great Britain and Ireland. We expect sales in the United Kingdom to begin gradually starting in the finished channel in the second quarter. We expect additional international expansion this year. And as previously stated, we are taking a methodical approach to our international growth and we will be following our international growth playbook in each new market we enter.

The Energy Market

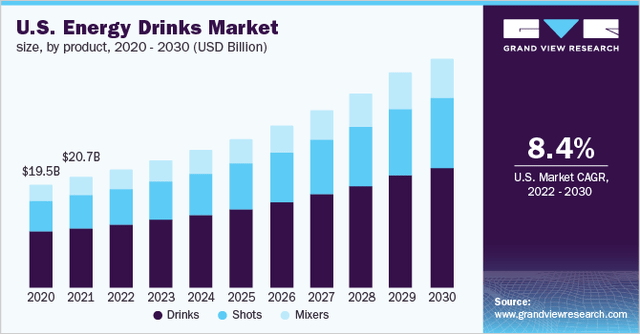

According to Grand View Research, the U.S. Energy drinks market will continue to grow at an 8.4% CAGR through 2030.

Grand View Research

In addition, there is more and more focus on the health aspect of these drinks. Think about zero sugar and zero calories. In fact, while I’m writing this I’m drinking a Monster zero calorie, zero sugar. I haven’t had the chance to try a Celsius drink yet, but I definitely plan on doing so in the future.

In addition, the total market size in 2022 was $91.94B, according to Grand View Research. This indicates that the market is huge and that Celsius has a lot of untapped potential left. The pioneers are clear, both Red Bull and Monster Beverage are the leaders in the industry. But, Celsius has been able to penetrate a very competitive market. Due to its effective branding strategy and the quality of its products.

Monster Beverage can be seen as the blueprint company and just like Monster did in the past, Celsius is now capitalizing on consumer trends like healthier energy drinks and a fresher image to attract young adults. Celsius’ partnership with PepsiCo, as we mentioned earlier, is key to sustaining growth and penetrating new markets.

Celsius has seen rapid growth and is currently winning in the energy drink market, quickly outpacing it peers like Bang Energy, which was all the hype just a few years ago, or Rockstar Energy. This shows that Celsius is doing something right, which other competitors are failing to achieve.

Celsius has built its brand around a lifestyle. This means that they aren’t marketing themselves as a simple energy drink. They are focusing on a very broad customer base focused on healthier energy drink alternatives. Celsius targets this market through efficient social media and content marketing.

CEO John Fieldly also addresses the much broader TAM that Celsius has compared to the normal energy market, as discussed during the earnings call:

We see that Celsius has a much broader opportunity when you look at the TAM versus say, traditional energy, we’re seeing consumers, consumer consumption increase outside of that energy need state. We’re seeing the product being paired with sandwiches and smoothies and bowls and a variety of opportunities for fast casual. So I think it’s a little bit too early for us to really know how big that opportunity is.

This shows in Celsius’ strong customer base. Keep in mind that this slide dates from March of last year and has expanded further as Celsius had another incredible year. Unfortunately, we don’t have this data available for FY23 yet.

Celsius Investor Presentation

More Financials and Valuation

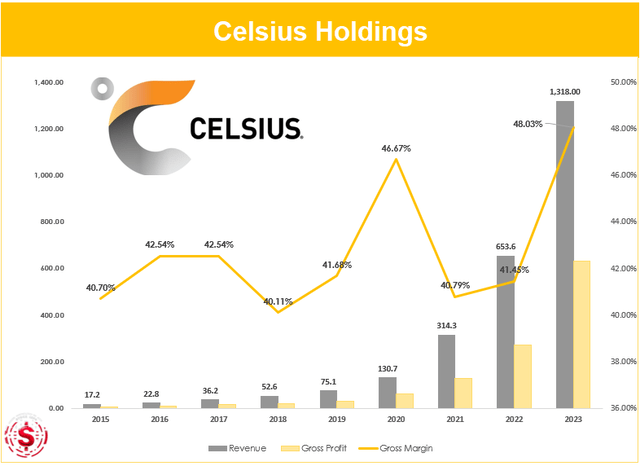

As we mentioned earlier, Celsius has been able to grow its revenue at a rapid pace. Revenue has compounded at 77.36% per year over the last 5 years.

The gross profit compounded at an even more impressive rate with a 5-year gross profit CAGR of 82.47%. Keep in mind, the company has been able to grow while increasing its gross margin. This is impressive, especially in an industry that is dominated by a few giants, which we mentioned earlier.

Stock Info

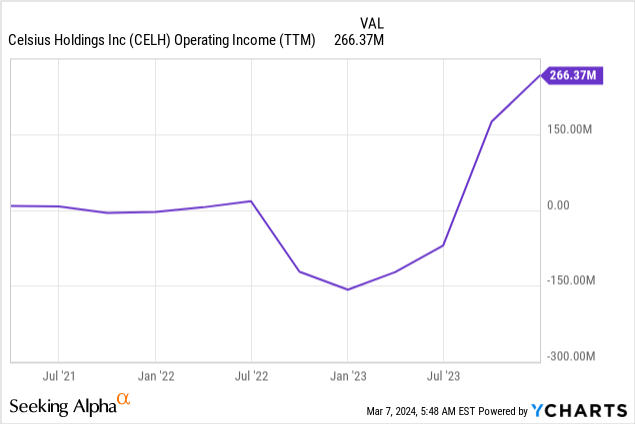

When we look at operating income we see that while the company had an operating loss of $30.4M in Q4 2022 it now posted a $58.9M in operating income. This is the 4th consecutive quarter of positive operating income, which just shows how strong 2023 was for the company.

Seeking Alpha

Ycharts

The results were also influenced heavily by the partnerships that Celsius had to quit for its Pepsi partnerships. So, the dip you see is artificial. Pepsi paid all of the charges from the broken contracts with other suppliers.

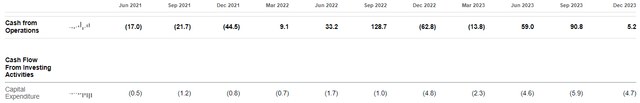

In addition, Celsius achieved 3 consecutive quarters of positive free cash flow, while Q4 cash from operations of $5.2M isn’t high it was a strong increase compared to the same quarter last year when it came in at $62.8M.

If Celsius continues this trend it can become a cash flow machine in the future.

Seeking Alpha

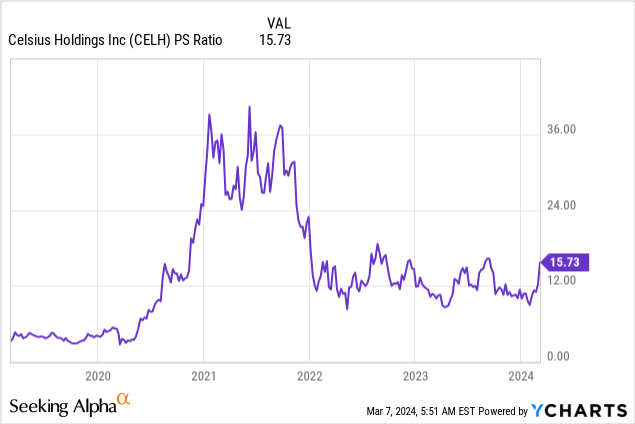

When we take a look at Celsius’ PS ratio we could say it isn’t that expensive at all. Agreed, the price has soared after the recent earnings, but Celsius has seen strong revenue growth alongside it. While the stock might be a bit overheated in the short term, there is still plenty of room for further upside.

Ycharts

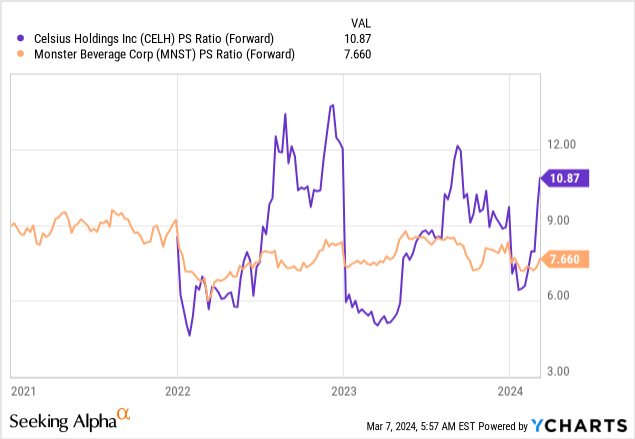

When we look at Monster, the market leader, which shows much lower growth numbers. We can see that Celius’ forward price-to-sales ratio isn’t that much higher than Monster’s while Celsius is showing faster growth rates and might be taking market share from Monster and Red Bull in the future.

Ycharts

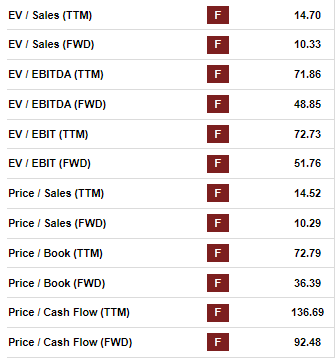

On the other hand, the company isn’t cheap. if we take a look at Celsius’ valuation grade on Seeking Alpha, we see the following. Celsius gets an F-grade on all of the below valuation metrics.

Seeking Alpha

While you might think “I’m going to stay away from this stock at the current valuation” when looking at the above valuation grades. It is important to note that you should take into consideration that these grades are in comparison to the sector. Celsius is simply growing much faster than the likes of Coca-Cola (KO) or others.

While this company won’t become a 100 bagger as the market is simply too small at this moment in time. Nonetheless, we believe the stock still has ample room for further expansion, which leaves room for further stock price appreciation. Especially, international expansion allows room for further growth.

Risks

As mentioned earlier, there are a few potential risks to the Celsius thesis, which can’t be neglected.

First of all, competition. Celsius is operating in an industry that is highly competitive with established companies in it. This could make it hard for Celsius to compete with said companies. However, Celsius has proven that it can grow rapidly while increasing its gross margin, which is a sign of pricing power. In addition, Celsius is focusing on a more niche segment due to its target group being people interested in lifestyle and fitness, which is how Celsius markets itself.A second potential risk is the European market. Currently, Celsius hasn’t focused on the European market. Nonetheless, if the company wants to continue its rapid growth it is a must that they sooner or later need to penetrate the European market.

Celsius Investor Relations

While the European market is quite a bit different compared to the North American market, Celsius’s effective branding and its partnership with Pepsi Co. makes them more likely to successfully penetrate the European market (I would love to try a Celsius here)

Technical Analysis

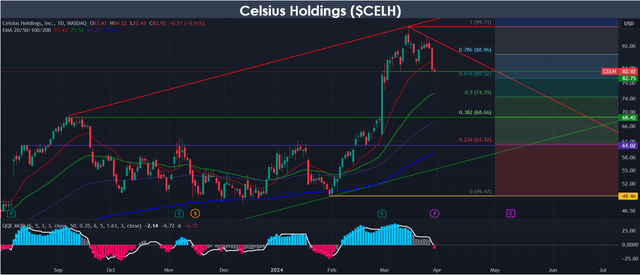

At its current stage, Celsius is a stock you want to own for the long term. The fundamentals remain strong and as long we don’t see any deterioration the long-term shareholder shouldn’t be worried.The stock has been struggling over the last 2 weeks. The stock is down over 17% since it reached its all-time high of $99.71 on March 14th. Nevertheless, the stock is still up over 65% compared to its 2024 low at the end of January.

Stock Info with Tradingview

Celsius stock is currently at an interesting level, trading around the post-earnings jump lows. Nevertheless, Celsius stock recently lost the 20D EMA, this could indicate further bearish momentum in the short term. A fall toward the 50D EMA, which is currently around $75, is a possibility.

The stock needs to hold this level otherwise more downside is highly likely. Although it shouldn’t be surprising the stock is currently cooling down a little after that spectacular run-up of over 100% in just one month and a half that Celsius experienced.

Furthermore, a drop towards the 0.382 Fibonacci level, which corresponds with last year’s high, would provide a strong support level and a potentially interesting point to open a position in Celsius.

For short-term traders, it is crucial to keep a close eye on the chart. For the long-term investors Celsius remains a fabulous company, but they need to be able to stomach potential downside in the near future.

Conclusion

Celsius posted an excellent quarter once again with strong growth numbers. Celsius achieved a record-breaking revenue of $347M, which is up nearly 95% year-over-year.

Celsius has benefited from its strategic partnerships with industry giants like PepsiCo, which will continue to drive further growth in the future. In addition, to Celsius’ strong marketing and brand affinity while promoting a healthy lifestyle, this could be the ideal cocktail for success.

Looking ahead into the next few quarters, Celsius remains focused on growth initiatives such as increasing distribution points and international expansion. Competition will remain strong, but Celsius has shown it can find its way into the market in its own unique way.

Last but not least, this year Celsius has shown it is setting itself up for sustainable long-term success. This can be seen through the consecutive quarters of positive free cash flow and positive operating income while growing both of these at a steady pace.

Overall, it was another excellent quarter for Celsius and it seems like 2023 might have been its breakthrough year.

from Finance – My Blog https://ift.tt/EFMiAZc

via IFTTT

No comments:

Post a Comment