Diy13

Final February, I began protection of Antero Midstream (NYSE:AM) with a “Purchase” score, citing advantages coming from upcoming rebate roll-offs, a current acquisition, and a dedication to decrease its leverage. The inventory has generated a 24% return since then, conserving tempo with S&P. I final coated the inventory in November, saying I assumed a possible distribution enhance someday in 2024 may very well be a catalyst. The inventory has a return of -4% versus a ten% achieve within the S&P over the identical interval. With AM rebounding after earnings, let’s meet up with the title.

Firm Profile

As a fast refresher, AM is a midstream firm. It owns a system of low-pressure and high-pressure gathering pipelines that primarily serve its largest buyer, E&P Antero Sources (AR). It additionally owns a 50% stake in a three way partnership with MarkWest, a subsidiary of MPLX (MPLX), to develop processing and fractionation property within the Marcellus and Utica. As well as, it additionally has a freshwater supply enterprise, which is used within the drilling of wells and different related actions.

Its contracts are fee-based or serviced-based with inflation escalators, so it’s largely a play on pure fuel volumes coming from AR. Notably, AR owns 29% of AM.

This fall Outcomes

Given its ties to AR, AM’s outcomes are very depending on the drilling exercise of AR. The E&P noticed its This fall manufacturing rise 6% yr over yr. That in comparison with a 9% enhance in Q3, a 5% enhance in Q2 and a 3% enhance in Q2. Its pure fuel volumes rose 7%, whereas ethane volumes have been down -6%, C3+ NGL volumes have been up 7%, and oil volumes have been up 46% off a low base.

AR guided for 2024 manufacturing of between 3.3-3.4 Bcd/d. It expects a -3% decline in pure fuel volumes and a 2% enhance in liquids volumes. Internet manufacturing averaged 3.4 Bcd/d in 2023 and in This fall. AR expects to be FCF constructive, regardless of the extraordinarily weak pure fuel costs and being unhedged, helped by NGL costs.

For its half, AM noticed a its low-pressure gathering volumes enhance by 10% to three,377 MMcf/d and a 14% enhance in compression to three,343 MMcf/d. Excessive-pressure gathering rose 10% to three,047 MMcf/d, whereas freshwater supply fell -15% to 94 MBbl/d. Its acquisition of Crestwood, which closed in This fall of 2022, helped enhance low-pressure volumes.

Gross JV Processing volumes, in the meantime, climbed 12% to 1,649 MMcf/d, whereas gross JV fractionation volumes jumped 11% to 40 MBbl/d.

The stable quantity development led to a ten% enhance in adjusted EBITDA to $254.0 million for AM. Free money move, in the meantime, soared to $156.4 million from $115.7 million a yr in the past, because it noticed decrease capex and better web earnings.

AM ended the quarter with leverage of three.3x, down from 3.4x final quarter and three.7x on the finish of 2022. It continues to focus on 3.0x leverage by the tip of this yr.

Trying forward, AM forecast full-year adjusted EBITDA of between $1.02-1.06 billion, a rise of 5% on the midpoint. CapEx is projected to be between $150-170 million, a -14% lower versus final yr. Free money move is predicted to be between $670-710 million. It anticipates paying out roughly $435 million in dividends and producing free money move after dividends of between $235-275 million. Notably, the corporate is anticipating $190 million in curiosity funds, a discount of -13% versus 2023.

AM plans to take care of its annualized dividend at 90 cents. It additionally approved a $500 million share repurchase plan that it might use as soon as it hits its 3.0x leverage goal.

With pure fuel costs within the dumpster, there have been fears that AR might pull again on its manufacturing, which might damage AM’s gathering volumes. Nonetheless, its dad or mum will look to maintain volumes regular, as it’s a nonetheless projecting to be FCF constructive.

In the meantime, AM will profit in 2024 from the roll off of prior rebates the agency gave to AR in addition to inflation escalators in its contracts. On the identical time, the corporate’s FCF money move will profit from decrease curiosity expense and diminished capex.

Trying in direction of 2025, until there’s a huge rebound in pure fuel costs, I would as soon as once more anticipate AR to maintain volumes flattish. So 2025 needs to be fairly just like 2024 for EBITDA, after which FCF ought to develop from diminished debt and decrease rates of interest.

Valuation

AM trades at 8.1x the 2024 EBITDA consensus of $1.06 billion. Based mostly on the 2025 EBITDA consensus of $1.09 billion, it’s valued at 7.8x.

The inventory has a free money move yield of about 12% based mostly on 2024 projections calling for $690 million in FCF. It pays out a dividend yield of ~7.3%.

The corporate was leveraged 3.3x on the finish of Q3 and anticipates getting to three.0x leverage by the tip of 2024.

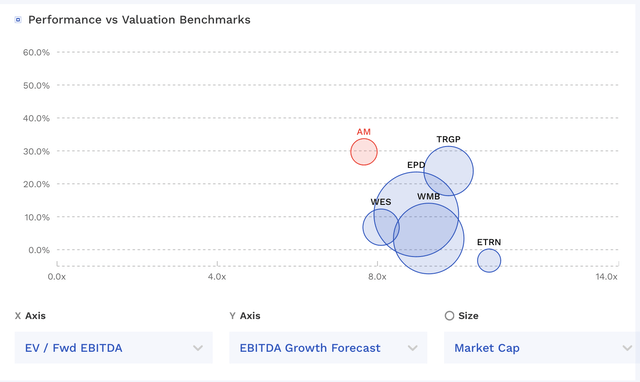

AM has one of many cheaper valuations within the area.

AM Valuation Vs Friends (FinBox)

I’d worth AM just like its friends, as I believe the fears of any volumes declines are possible overblown. An 8-9x a number of on 2025 EBITDA would worth the inventory between $13.50-15.50 after considering about $250 million in debt reductions.

Conclusion

AM reported sturdy This fall outcomes and extra importantly issued stable 2024 steerage, though a lot of the investor reduction possible got here from AR’s steerage of conserving manufacturing flat and with the ability to keep FCF constructive. The corporate will profit this yr from rebate roll-offs, however as we glance in direction of 2025, the inventory will possible turn out to be extra of a capital allocation story. Decrease pursuits charges will surely assistance on that entrance, and result in extra FCF.

Whereas I wish to have seen the corporate point out a distribution enhance later within the yr that doesn’t seem like it’s within the playing cards. Nonetheless, I believe it’s a good chance in 2025 after it reaches its leverage goal. With an FCF yield far exceeding its distribution yield, the corporate may have amble alternative to extend it, and decrease capex and curiosity expense will solely bolster free money move in 2025.

AM’s mixture of worth upside and distribution proceed to make it a “Purchase.” My $14.50 worth goal stays unchanged.

The most important danger to the corporate can be if AR diminished its manufacturing steerage, which was a concern going into its report and certain why AM’s inventory had been weak. Nat fuel costs are already very low, and AR hasn’t modified its plans, but when NGL costs plunge, it may very well be a distinct story. For now, these, the worst fears are over.

from Finance – My Blog https://ift.tt/icoqJpE

via IFTTT

No comments:

Post a Comment