hqrloveq/iStock by way of Getty Photographs

Essential Thesis/Background

The aim of this text is to debate the present macro-environment of the market proper now, with a particular concentrate on the implications for tax-exempt municipal ((muni)) bonds. That is high of thoughts for me for just a few causes. One, the bond market as a complete (together with munis) had a fairly unstable 2023 that included a surge greater within the ultimate phases of the 12 months. This, on the very least, warrants some examination.

Two, fairness markets are very complacent to various headline dangers and are getting extraordinarily concentrated by the rise within the “Magnificent 7”. This implies to me that diversification – both via different fairness positions or via hedges like munis – make a number of sense proper now. Three, the Fed continues to trigger a number of yield volatility within the treasury market. This complicates the outlook for bonds and warrants shut monitoring in the months forward.

On this overview, I’ll clarify why I proceed to view the muni sector positively. I see a number of advantage to constructing (or initiating) positions at these ranges – primarily for high-income traders and/or those that anticipate some degree of correction within the fairness market. I’ll dig into the explanations behind my sentiment, in addition to some choices to decide on to enter this sector.

Fairness Optimism Suggests A Place For Hedges

To start I’ll take a second to debate a number of the explanation why readers could wish to think about munis now. As my followers know, this has been a long-term sector allocation of mine as a working skilled in the next earnings tax bracket. So I see advantage to this publicity in most cycles (minus when the Fed is embarking on an aggressive rate-hiking cycle!). However this might not be the case for everybody relying on their particular person circumstances. Nonetheless, there are reliable causes for giving this sector consideration in the intervening time.

One motive particularly is the bullishness within the fairness market. Whereas munis are unrelated to equities – that’s exactly the purpose! They usually function an fairness hedge, performing properly on down days and vice versa. This may also help defend traders from upcoming volatility and/or losses within the fairness market, and assist steadiness out an equity-heavy portfolio – corresponding to my very own.

To assist why I really feel fairness ranges as a complete are stretched, we will look at various completely different metrics. However one particularly that’s placing to me is what’s going on within the futures market. Asset supervisor’s positioning in equities suggests the very best long-equity stance in practically two years:

Asset Managers: Fairness Positioning (Bloomberg)

If that does not shout “euphoria”, I am unsure what does. Of concern, think about that in mid and late-2021 is the place positioning was this excessive. Everyone knows how large-cap US shares carried out in 2022 (trace: poorly).

This is only one motive why I consider fairness hedges have some worth right here. Fairness markets are stretched and if earnings do not sustain a number of draw back could also be forward.

Why Munis? State and Native Governments In Respectable Fiscal Form

Whereas I mentioned within the prior paragraph that I’ve considerations with fairness ranges – as measured via the S&P 500 – that does not robotically make munis a purchase. There are many different methods to hedge fairness danger. One is non-US shares. One other is money. A 3rd that’s most related to this dialogue in company or treasury bonds. Muni bonds are only one space of the fixed-income market. This makes it essential to look at how engaging they’re relative to different earnings choices earlier than diving in.

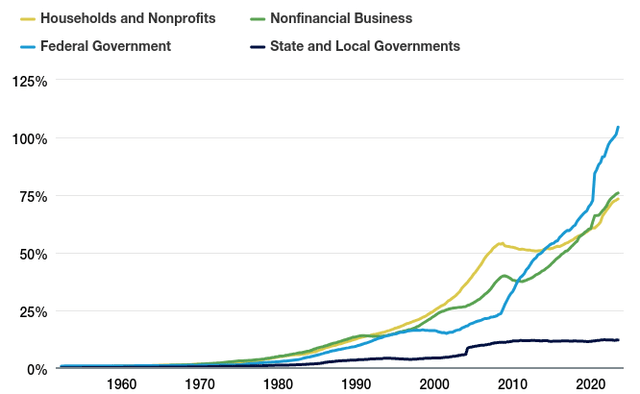

On this respect, I see worth in munis in relative phrases. Whereas the federal authorities and companies – each extremely rated and junk-rated – have binged on debt prior to now decade, state and native governments haven’t. This is because of various components, specifically of which they can not borrow and spend the best way the Feds can. The web result’s that state and native governments at the moment have much less debt – as debt ranges have risen modestly whereas ranges for households, the federal authorities, and US companies have seen debt ranges surge by comparability:

Change in Debt Ranges (By Issuer Sort) (US Financial institution)

What this means to me is that state and native governments are in first rate form to kick-off the 2024 calendar 12 months. They are not going through the identical excessive burden of debt ranges, and that implies to me the ahead outlook is rather less cloudy.

That is essential for my part, particularly for many who wish to transfer down the credit score ladder and into excessive yield securities. I personally personal excessive yield muni publicity and I desire it to below-IG rated company debt. One motive is as a result of tax-exemption, however the different is that cracks within the company sector have a tendency to seem first, earlier than reaching the muni market. So I desire to capitalize on excessive yields within the safer muni sector in consequence – and that has served me properly over time.

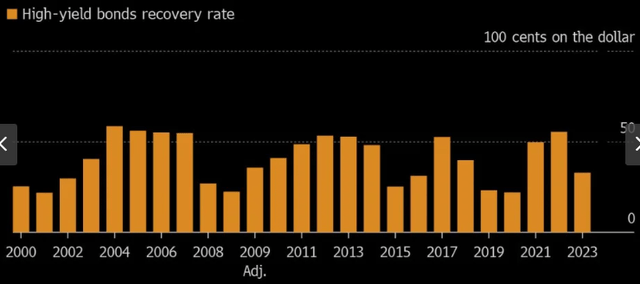

I believe that is positively some extent to emphasise in the interim. It’s because there are some cracks rising at this very second. Throughout the junk-rated company bond sector, mortgage recoveries have been on a pointy decline in 2023. Because of this when a borrower is in misery or enters chapter proceedings, the proportion of the mortgage that the lender finally recovers has been dropping:

Bond Restoration Charges (Excessive Yield Corporates) (Yahoo Finance)

This leads to greater losses for lenders and, finally, the traders in these securities. Given the dramatic shift on this determine, I am not optimistic it should all of the sudden enhance simply because the calendar reads “2024”. I see this weak point and historic low degree of recoveries as additional assist that investing in munis, on the expense of corporates, is the suitable transfer to make.

**I personal the VanEck Excessive Yield Muni ETF (HYD).

Earnings Stream Is Traditionally Elevated

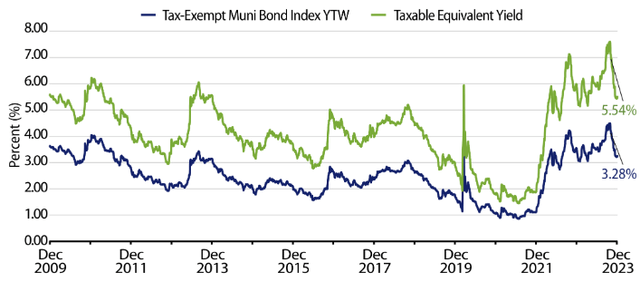

Past credit score high quality, another excuse for contemplating munis is the earnings stream. Whereas munis (as a complete) participated within the This autumn rally that has resulted in pushing present yields down a bit, they continue to be traditionally elevated when in comparison with the prior fifteen years:

Present Yields (Bloomberg)

As you’ll be able to see, when each absolute yields and tax-adjusted yields for the upper tax brackets, traders in munis can earn upwards of 5.5%. That’s pretty interesting, particularly as inflation has come down and the Fed has not instructed any extra price hikes are on the best way within the close to time period – with the potential for cuts in some unspecified time in the future in 2024 to be the extra doubtless situation.

I’ll observe that there would not seem like a complete lot of urgency to lock in these yields, given the Fed has poured chilly water on a March price lower (and instructed a extra hawkish path in 2024 than the market is hoping for). I say this as a result of I do not need readers to “panic purchase” this sector now – or another fixed-income sector – as a result of the chance might be round for some time.

However the flip-side of that’s the market can transfer quick. This autumn confirmed us how beaten-down sectors can rebound swiftly and I’d advocate getting your geese in a row to maneuver on this chance within the short-term. I personally have some muni publicity and will likely be including to it over the following few months as a result of the fact is that treasury yields will in all probability finish the 12 months decrease, not greater. This implies all through the primary half of 2024, individuals in all probability wish to be shopping for this sector, fairly than promoting or avoiding.

**Along with HYD, I’m shopping for particular person points from my dwelling state of North Carolina which can be primarily transportation and GO-focused. I proceed to suggest readers discover tax-exempt munis of their dwelling state for the most important tax benefits.

Dangers and Traits To Hold An Eye On

As with every inventory, fund, or thematic thought I’ve, I’ll take a while to debate the dangers. Paramount for the muni area – particularly within the excessive -ield nook – is credit score high quality. I mentioned earlier how I consider credit score worthiness is stronger in munis than corporates (treasuries are actually the most secure, however munis yield extra). I do not see any motive why munis will expertise extra defaults than corporates this 12 months. That’s virtually by no means the case and company bonds have loads of their very own headwinds to deal with.

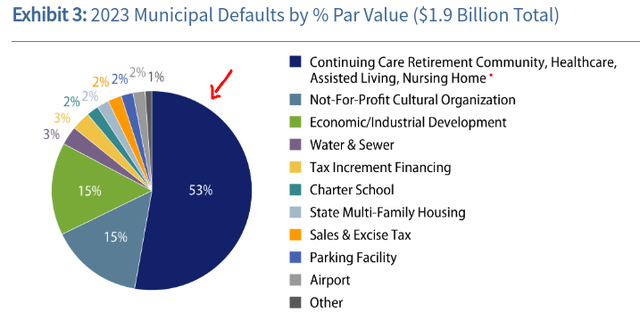

However that does not imply munis are “danger free”. Specifically, readers ought to perceive that when defaults happen on this sector, they are typically concentrated within the Well being Care/Well being Providers sub-sector. This has been the pattern for actually the previous decade, and principally notable within the final 5 years. The reason being easy: not like GO-bonds, points from well being care suppliers or hospitals solely have revenues as a supply of reimbursement. This makes these bonds riskier than bonds issued by states or native governments, and even income sources which have the power to lift via income via greater use charges (i.e. toll highway rising what they cost).

The impression of that is vital. When defaults do happen on this broader sector, they’re overwhelmingly concentrated in health-related arenas. It is a crucial danger traders want to guage earlier than shopping for any muni fund or particular person challenge:

2023 Muni Defaults (By Sector) (Western Asset Administration)

I convey this up as a result of many CEFs exist for munis and they’re a well-liked strategy to place this area. Given using leverage, yields may be fairly engaging. Additional, many CEFs from well-known retailers like PIMCO, BlackRock (BLK), and Nuveen have a plethora of funds buying and selling at reductions (typically substantial reductions) to NAV. This will appeal to value-oriented consumers.

However my concern is that if individuals purchase these funds with out actually understanding what’s in them. A fund might have a double-digit low cost to NAV, for instance, for a great motive. Maybe it’s closely allotted to health-related bonds which can be teetering and will default. Or maybe the problems usually are not rated in any respect, creating an absence of transparency behind how dangerous this specific fund is. I take advantage of muni CEFs myself, so this isn’t an total knock on this funding thought. However I’m utilizing this area to counsel readers dig fastidiously into the holdings of any fund they wish to purchase and to verify one isn’t blinded by the yield or the valuation on the floor alone.

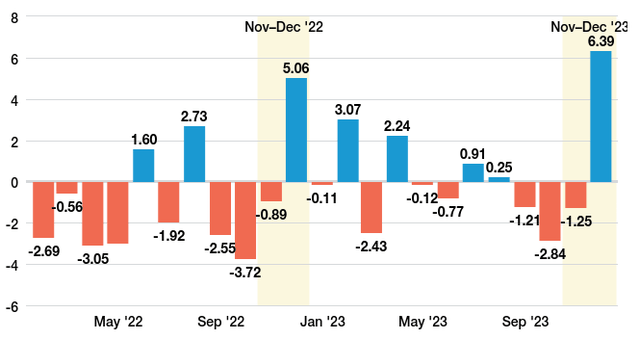

One other danger to think about is the muni sector has gotten extra unstable than in a long time previous. For older traders, they might bear in mind when munis had been a boring, set-and-forget space. Whereas it may possibly nonetheless be that method, the final two years have seen an uptick in volatility on this area. As talked about earlier, munis ended 2023 on a really robust observe, however the first half of the 12 months was fairly ugly. And 2022 noticed some huge swings too:

Month-to-month Efficiency of Municipal Bond Sector (S&P International)

This isn’t meant to alarm. I stand by my name that munis supply some worth right here. However it could be naive to suppose it’s going to be a straight shot greater. There was fairly a little bit of volatility in the previous couple of years and that does not disappear in a single day. So make sure you ladder in, know your personal danger tolerance, and to not panic, however fairly, to make the most of the swings.

Backside-line

The muni sector has been a main part of my portfolio for a very long time and I do not see that altering in 2024. After I lightened up on my publicity final 12 months, I see a way more favorable setting going ahead and will likely be rebuilding my place. That is as a result of potential for Fed price cuts within the second half of the 12 months (my prediction), a declining inflation setting, traditionally elevated yields for munis, and financial restraint by many state and native governments, relative to their company counterparts.

I personally suppose readers will likely be well-served by discovering particular person points for GO bonds, transportation bonds, and utility-backed bonds of their dwelling state. Apart from that, I see worth in excessive yield muni ETFs, in addition to CEFs that aren’t extensively leveraged and/or don’t have too heavy of an allocation to well being care techniques or hospitals. I’m hopeful readers will have the ability to revenue off this sector within the 12 months forward.

from Finance – My Blog https://ift.tt/tLEme3w

via IFTTT

No comments:

Post a Comment