TomasSereda

I recently decided to take another look at gold miners, and New Gold Inc. (NYSE:NGD) caught my attention. I typically prefer the smaller miners, as their operations are easier to track and break down, and they are often given a discount by the market for their size. That said, not all miners, big or small, are winners, and miners are almost infamous for their ability to erase capital, so proper analysis is warranted.

Based on my review of New Gold, I believe that it is showing signs of being a turnaround. Development of their two mining assets has had incremental successes, and they will be increasing production in the near future. Yet, I will outline the complications that make me hesitant to buy until a turnaround has substantially materialized and why -instead of being a hold – NGD is a SELL.

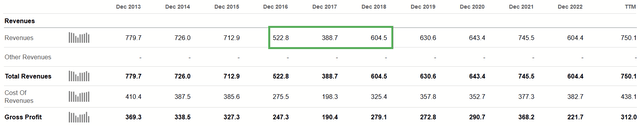

Recent Financial Data

As we see over the last decade, the company experienced a significant decline in revenues about halfway through that period.

Revenues

Seeking Alpha

Yet, we can see the ship has been steadying, returning to revenue levels of the past. The cash flow situation has some more subtlety to it.

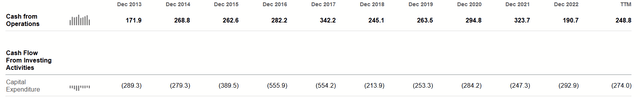

Cash Flows

Seeking Alpha

Capex competes heavily with operating cash flows. This is part of the reason why the stock trades around a buck-fifty, compared to its high points in the past. Investors are less sure of this business’s ability to generate cash.

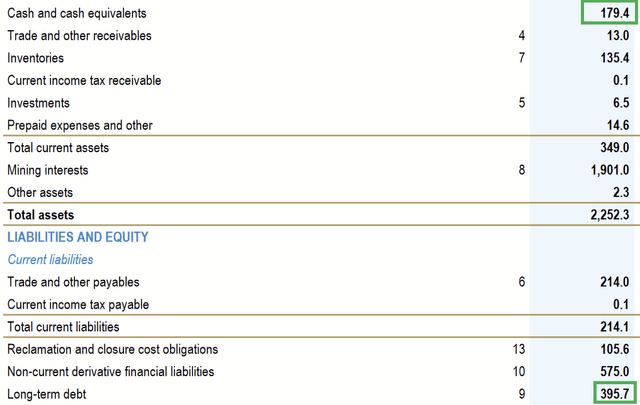

Seeking Alpha

Balance Sheet

Q3 2023 Investor Presentaton

The table shows that they have $395.7m in long-term debt, while sitting on $179.4m in cash. That debt comes due in 2027, so there is some time to get it paid off. With TTM operating cash flows near $250m, there is potential to get this debt paid off and complete the transition to a cash-generative business for shareholders. It’s a matter of increasing production and getting all-in sustaining cost (AISC) down. A look at their mining assets will make it easier to make sense of all of this.

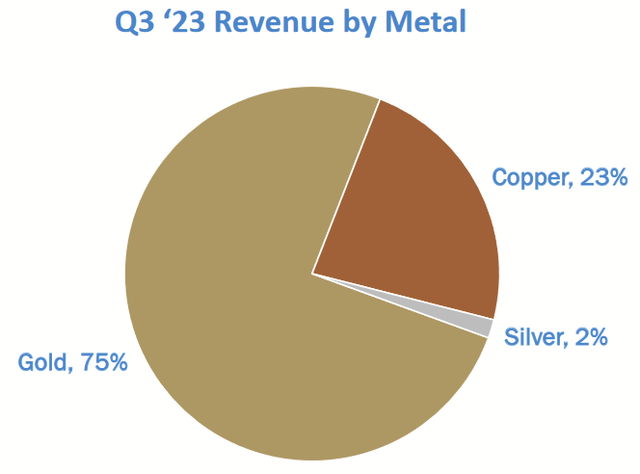

Mining Operations

New Gold owns and operates two mines in Canada, Rainy River and New Afton. While creating gold revenues, a substantial amount also comes from copper, and a lesser amount comes from silver.

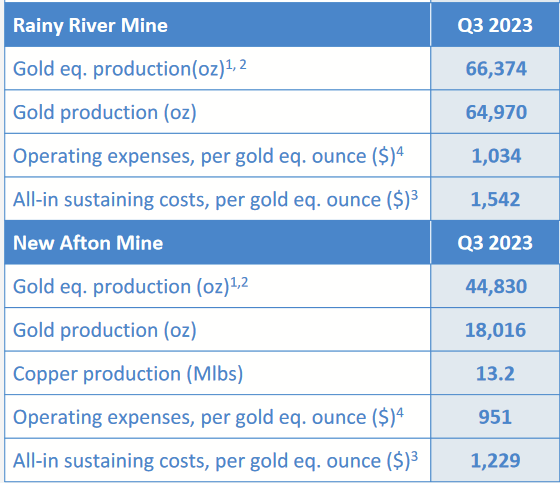

Q3 2023 Investor Presentation

Rainy River was acquired in 2013 and began producing ore in 2017 (which tracks the rise in revenues). It also accounts for a minor amount of silver production. It consists of both an open pit and an underground component. In the 2022 annual report, the company reported a life of mine up to 2031.

New Afton was acquired in 1999 but didn’t begin producing ore until 2012, after a substantial geological study of the site’s potential. In addition to gold, this property accounts for the company’s copper production. Its life of mine is currently up to 2030.

Q3 2023 Investor Presentation

Rainy River accounts for a majority of production, but its AISC is higher, meaning that the cash the two can produce for the company is about even.

Improving the Mines

The company has been working on developing its mines to increase the production of ores and reduce costs.

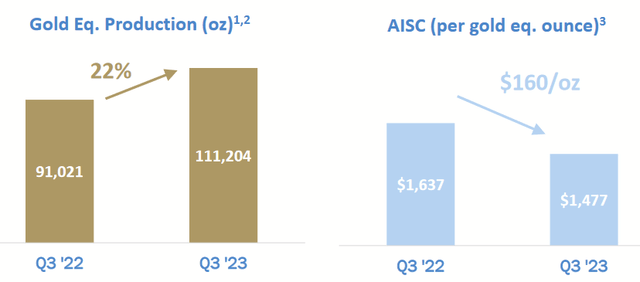

Q3 2023 Investor Presentation

As these charts show, production was up 22% from last year, while AISC was down almost 10%. That’s a dramatic improvement to margins going forward and thus cash flows. Management noted in the Q3 2023 Earnings Call:

As Pat mentioned, the company generated $22 million of positive free cash flow in the quarter. Rainy River continued to deliver free cash flow and has generated $85 million in free cash flow over the last two years. New Afton had its first positive free cash flow quarter in almost two years despite the ongoing investment in C zone [ph]; this is a testament to strong operating performance in the quarter.

While this is good news, it remains to be seen if positive cash flows for both mines will continue. Currently, management is looking at chances to improve the mines and extend their lives beyond current projections.

A Look To the Future

C-Zone Addition to New Afton

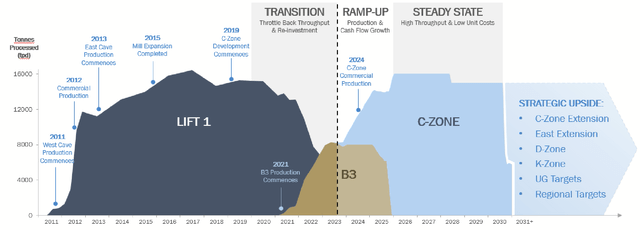

Management is very ambitious about New Afton’s potential. The current addition of the C-Zone to the mine will be a major boost to production.

Q3 2023 Investor Presentation

As the chart above shows, this can almost double production from present levels at New Afton. Q1 2024 should be insightful on how well execution goes.

Cash Flow Situation

With operating cash flows being above $200m generally each year, increasing production and reducing capex upon completion of improvements like C-Zone should allow free cash flow to rise significantly from where it has been recently. Given its fluctuation between positive and negative amounts, it’s only averaged $5m annually over the last five years, based on historical data. With recent changes and the company reporting FCF of $22m in Q3 2023, there is potential for the average to rise somewhere from $50m to $100m per year for the foreseeable future.

As the lives of the mines are currently for 2030 and 2031, with $395.7m in debt due 2027, we’ll want to watch carefully what the company does. Will it successfully pay this off? Will it start distributing extra cash to shareholders with a dividend? Will it reinvest some of this cash to extend the lives of the mine successfully or acquire other ore-rich assets?

Gold Prices

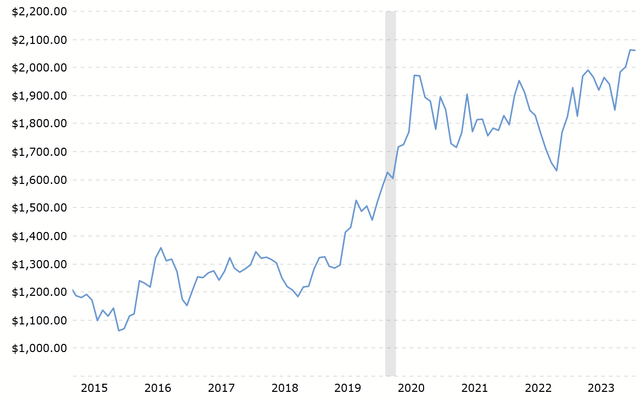

A lot of this good news for the company depends on gold prices remaining high. Take a look.

Macrotrends.net

We have seen, not very long ago, that gold prices were below the AISC for the company. It’s currently benefiting from a higher price, but this demand may not last. Since will need prices to be higher like they are in order to pay off that upcoming debt, this strikes me as the largest risk facing the company in the near term.

Valuation

If I felt confident about the company, a valuation would look like this.

Author’s calculation

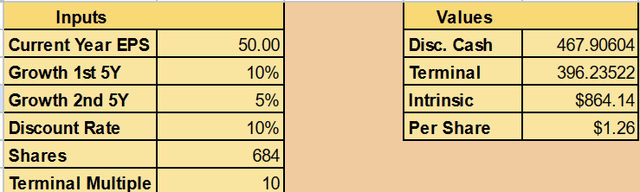

Here I use the baseline of $50m in FCF, assuming it can grow 10% in the next five years and then slow down 5% as the C-Zone finishes. These assume that production rates continue to increase along their current track and that capex declines as major mine improvements are done, with the growth of output slowing down as these benefits are realized. A terminal multiple of 10 is to allow for future growth opportunities from yet-to-be-discovered expansions to the mines or acquisitions of new properties.

This Discounted Cash Flow gives a market cap of $864m for those seeking a 10% return and an intrinsic value per share of $1.26, marginally less than the current price.

The problem, though, is that my usual DCF calculates a decade of cash flows and then a terminal value for future cash beyond that. With lives of the mines currently ending in 2030 and 2031, it doesn’t seem like that kind of valuation is for sale. Then, of course, we have to remember the $395.7m in debt that is due in 2027. They have the cash to pay for about half of it, but that’s still a big chunk of the cash in the near future.

My point? I think the makings of a good investment are here, but we need to wait and see. The turnaround for New Gold isn’t simply making the current mines cash flow positive. The second and third hurdles include paying off the debt (avoid bankruptcy, to some) and having some home of cash flows for more than a decade.

Conclusion

New Gold is a small miner with two sites that mainly produce gold, with decent amounts of copper and a little silver thrown in there. With volatile cash flows after seeing major revenue declines over the last decade, it has improved the operating capacity of both to increase production with a lower AISC, while also benefiting from higher gold prices.

Yet, despite the optimism of Q3, the turnaround is not complete, and the market seems to be paying for something that has not occurred yet. I believe it is prudent to confirm that management can execute continued improvements to its mines, repay its debt, and create an origin of cash flows beyond the current lives of the mind (at least a decade from today). Until then, I think NGD is a SELL but a company worth watching.

from Finance – My Blog https://ift.tt/jYAnCUi

via IFTTT

No comments:

Post a Comment