Svitlana Ozirna/iStock via Getty Images

I tried, in vain, to find three more Fallen Angels to fill out our Dodgeball 7 portfolio. But after spending the week poring over about a zillion charts, opinions, and analyses, I must report that I could not find three that I would consider Angels – or at least none that I believe have the Right Stuff to rebound from where they now reside.

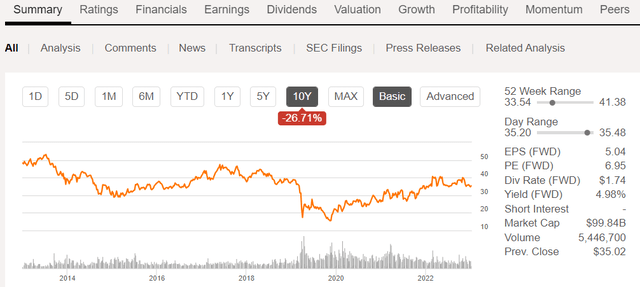

It may seem strange for me to consider this offering for your due diligence as a Fallen Angel. After all, it is up 1.2% over the trailing twelve months. But it is a company that has been down so long it looks like up to me. It has fallen a stunning 26.71% over the past 10 years.

Seeking Alpha

The company is BP p.l.c. (NYSE:BP), the 115-year-old UK-based oil and gas colossus that, like most European companies over the last 10 years, has been browbeaten and “encouraged” to diversify into solar, wind, carbon capture, hydrogen, etc. After Brexit, BP is freer to do what it does best: hunt for, find, refine, trade and sell oil and gas. BP also has a retail arm consisting of gas stations/convenience stores, Castrol and other specialty lubricants, and aviation fuel suppliers and operators. And its fair share of wind, solar, hydrogen, et al as well. For openers.

If BP has only bumped along for 10 years and is still down from that point, what catalyst makes me believe it will do well going forward?

First of all, don’t make “too” much of the share price alone. For all this time, BP has had an aggressive buyback program which reduces the float and therefore increases each shareholder’s share of the pie. They have also paid a fine dividend the entire time. For 2023, the current dividend yield is just a whisker under 5%.

Next, they have written off their entire investment in Russia and still had the cash flow to do the above. leaving Russia behind, BP has widened its global view and now has one of the most geographically diverse sources of oil and gas.

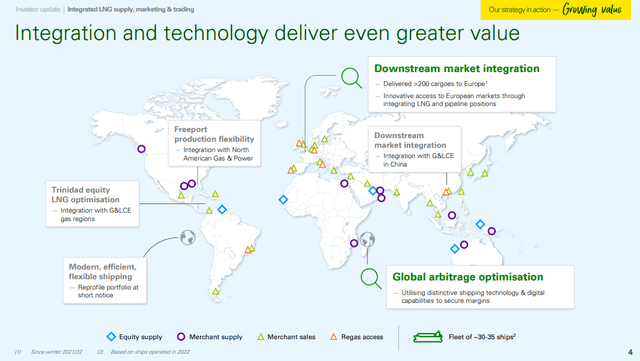

BP Presentation

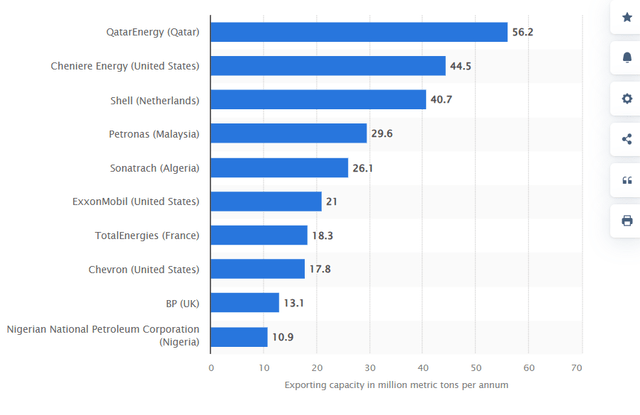

In addition, BP is focusing on LNG production, trading, and transportation. I believe they will close the gap on other strong competitors by redeploying assets from Russia and being more aggressive in the LNG business. This next chart, from Statista, is a bit deceptive because it lists the LNG storage facilities as of mid-2022 (even though it was published this year.)

If we remove the state-owned LNG powerhouses and Cheniere, which is not a producer of the gas (but a fine company as well!) we see that BP trails only Chevron Corporation (CVX), TotalEnergies SE (TTE), Exxon Mobil Corporation (XOM) and Shell plc (SHEL). [A disclosure: I own all these except Total – and I also own Norway’s FLEX LNG Ltd. (FLNG) and Equinor ASA (EQNR) in this space!].

Statista

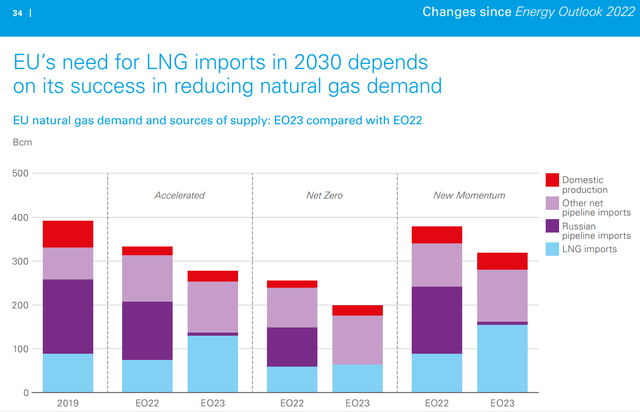

Why do I stress LNG? See below:

BP Energy Outlook 2023

Using three different ways of viewing how aggressively the EU is likely to regulate the use of non-petroleum sources of energy, no matter how it is sliced, LNG looks to be the wave of the future.

You can see next how BP is positioning to grow its share of the world LNG market:

BP Presentation

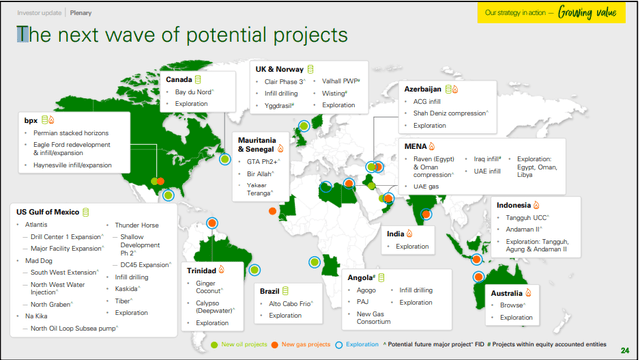

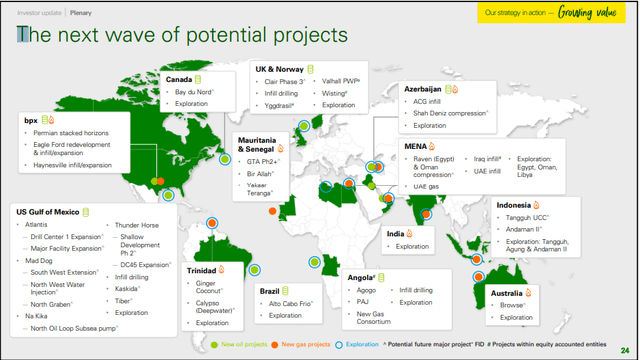

Finally, BP is increasing its global footprint in oil and gas to feed this need for LNG as well as traditional uses for oil (more than 1,000 different products that have nothing to do with burning oil for propulsion!) Take a look:

BP Presentation

BP also said in its recent Investor Presentation, tellingly in Denver, Colorado, USA:

“… we are committed to allocating 60% of 2023 surplus cash flow to buybacks, subject to maintaining a strong investment grade credit rating.”

Is my optimism that BP is about to turn the corner shared by others?

Nope. But I am accustomed to doing my own independent research and analysis that leads me in a different direction from the pack. Sometimes it pays to be too early — and certainly waiting for everyone to agree!

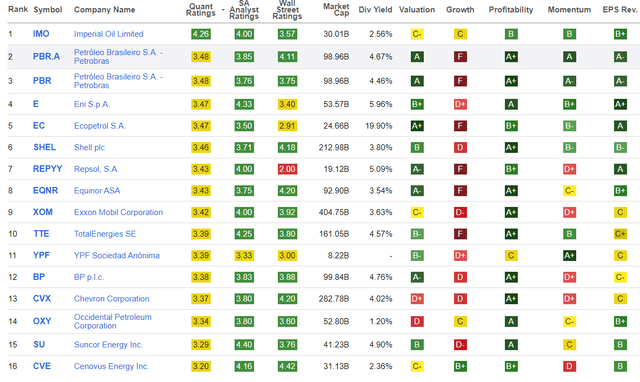

For instance, this is how Seeking Alpha’s Quant Ratings rank the top integrated oil and gas stocks:

Seeking Alpha

I have owned every single one of these companies at a time in their history when I thought it would be profitable. I even owned Cenovus Energy Inc. (CVE), but back then it was called EnCana Corp, which in 2009 split into CVE and EnCana (now Ovintiv – OVV – a name change I never understood. What was wrong with “Energy Canada” — EnCana?)

You will note in the chart above that SA Quant rankings show but one “Buy” rating for all these companies – Imperial Oil, an old favorite of mine from way back when. But Chevron Corporation (CVX) ranked #13 and BP #12. Not for me. I place these two at the top, not the bottom.

That’s what makes ball games and stock markets. Everyone is entitled to their opinion.

For me, after searching and searching to find even one Fallen Angel I could add to my list of potential 2024 rebounders, I found one right close to home, already in our Investor’s Edge® Growth & Value Portfolio. (For the previous four “on the rebound” choices, see here and here).

Good investing, enjoy the holidays, and have a great 2024!

Analyst

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment