da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist.

The Western Asset High Yield Defined Opportunity Fund (NYSE:HYI) provides investors exposure to a basket of high-yield corporate debt instruments from around the globe. While most closed-end funds often utilize leverage in an attempt to enhance returns, this fund takes a non-leveraged approach. That can give up some returns when times are going strong, but leverage also increases volatility and risks. Without borrowings, it also takes one more variable to consider away from this fund in terms of the costs of those borrowings.

At the same time, HYI is able to deliver a high distribution rate that is relatively competitive with peers. Additionally, and probably more importantly, that distribution is mostly covered through the income generated in the underlying portfolio.

Since our last update, the fund’s discount has narrowed a bit but remains fairly attractive over the next couple of years. The fund is a term structure, with the anticipated liquidation date at the end of September 2025. Due to a narrowing discount from our prior update, that would have contributed to a better total return in this period.

HYI Performance Since Prior Update (Seeking Alpha)

The Basics

- 1-Year Z-score: -0.24

- Discount: -5.50%

- Distribution Yield: 9.62%

- Expense Ratio: 0.95%

- Leverage: N/A

- Managed Assets: $275.33 million

- Structure: Term (anticipated liquidation date of September 30, 2025)

HYI has an investment objective of “high income, with capital appreciation as a secondary objective.” They “emphasize team management and extensive credit research expertise to identify attractively priced securities.”

They are free to invest across various types of fixed-income securities. However, they primarily focus on high-yield corporate debt, “…under normal market conditions, at least 80% of its net assets in a portfolio of high-yield corporate fixed income securities…”

The fund is fairly small, so liquidity can be an issue for larger investors who want to move in and out of a fund quickly. The average trading volume comes to around 52.4k shares a day.

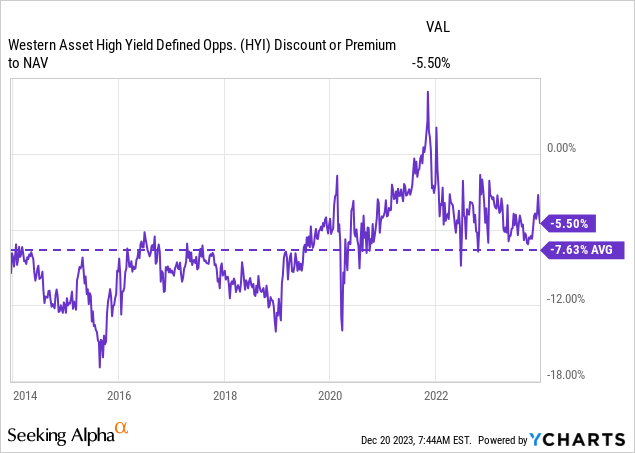

Discount Narrows

One of the ways that closed-end funds can be exploited is through unusually large discounts – or alternatively, unusually large premiums can indicate a fund is too expensive. Since our prior update, HYI has seen its discount narrow a couple of points. That being said, the fund isn’t trading at any sort of outlandish and absurd premium valuation to its average discount.

YCharts

Additionally, with a term structure, the fund’s discount should be realized at some point in the future. That should naturally see a narrowing of the discount the closer we get to this fund’s termination date, which is anticipated to be at the end of September 2025. That puts the liquidation date to less than two years, a period where the discount/premium becomes more relevant for term funds.

The caveat for these term funds is that they often have a way to extend out the term or switch to perpetual. A few of the funds that were term funds previously have switched to perpetual, but it does require shareholder approval. XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) is one of the latest funds that put it up for a vote to shareholders to switch the fund from term to perpetual.

Another example was Nuveen, which had two mortgage-related CEFs that went through tender offers, allowing investors who want to get out at NAV to do so. That resulted in the Nuveen Mortgage and Income Fund (JLS) surviving but Nuveen Mortgage Opportunity Term Fund 2 (JMT) being liquidated, as after the results, the fund wouldn’t have met the $80 million minimum in managed assets.

For HYI, more specifically, the fund’s Board has the option to extend the termination date. However, unlike most funds where the discretion is entirely up to the Board, HYI states that shareholders would have a say in any extension.

If the Board of Directors determines that under the circumstances, termination and liquidation of the Fund on or about September 30, 2025 would not be in the best interests of stockholders, the Board of Directors will present an appropriate amendment to the Articles at a regular or special meeting of stockholders. The Articles require either (i) the affirmative vote of at least 75% of the Board of Directors and at least 75% of the votes entitled to be cast by stockholders or (ii) the affirmative vote of 75% of the Continuing Directors (as defined in the Articles) and the approval of the holders of a majority of the votes entitled to be cast thereon by stockholders. Unless the termination date is amended by stockholders in accordance with the Articles, the Fund will be terminated on or about September 30, 2025 (regardless of any change in state law affecting the ability of the Board of Directors to amend the Articles).

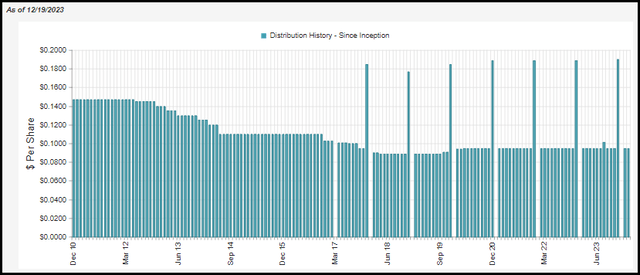

Quarterly Financials Show Respectable Coverage

The fund raised its distribution several months ago, taking it from $0.0945 to $0.095. This wasn’t a particularly large increase, but it was as Western Asset has been increasing the payouts of a number of their funds. In the grand scheme of things, on the distribution history of the fund, it is hardly noticeable after the steady declines during the zero rate environment.

HYI Distribution History (CEFConnect)

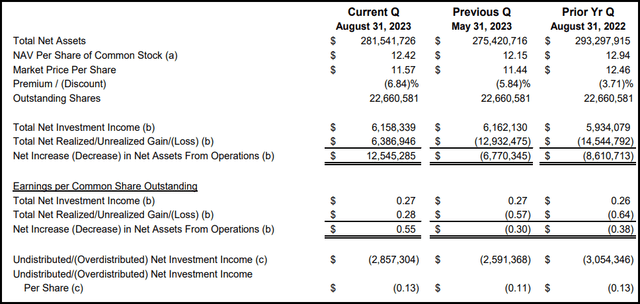

A higher-rate environment bodes well for fixed-income funds, but it can take some time to kick in. The fund’s net investment income in their last quarterly report was remarkably steady quarter-over-quarter – and even year-over-year, it was mostly steady as well. A one-penny increase isn’t bad news per se, but it’s essentially flat.

HYI Quarterly Financials (Western Asset)

Given the fund’s $0.095 monthly payout, we are looking at distribution coverage that is a bit lacking at only around 95%. That can make the distribution rate on the fund 9.62% a bit less attractive. We can also see a negative UNII balance for HYI, but that has also remained fairly steady. So they seem okay with overdistributing at least a bit over time.

This also means that the fund isn’t quite earning the 9.09% NAV distribution rate listed either. Thanks to the discount on the fund, investors do get a bit of a bump on what the fund has to earn versus what investors receive. The fund could see that NII is trending slowly but surely higher, making them comfortable with an increase.

Additionally, if we look at what could be considered the gold standard for high-yield bond CEFs, we can take a look at the BlackRock Corporate High Yield Fund (HYT). That fund runs with a distribution rate of 10.10%; however, that fund’s latest UNII report showed distribution coverage coming in at a less than 75% rate.

Going within the same family but going with Western Asset High Income Fund II (HIX), which is similar to HYI but leveraged, we can see the distribution rate comes to 11.81%. Interestingly enough, the fund is actually trading at a premium, so the distribution rate on NAV is higher at 12.10%. However, their last quarterly financials showed coverage was coming in shy of 82%.

Some quick back-of-the-napkin math would mean that the 10.10% rate HYT is paying should really be down to around 7.6%. At the same time, HYIs should also be reduced but not nearly as much, taking it down to around 9.2% ‘real yield’ that the portfolio is actually earning. For HIX, it would come in to around a 9.7% rate for investors and about 9.9% on the NAV rate. A better yield, but that needs to be weighed against the increased risks.

These are examples of where the leverage of HYT and HIX doesn’t actually lead to a relatively better or significantly better result. On the other hand, with rates set to be cut by the Fed, we could see that benefit HYT and HIX going forward. The spread should come down between what they are paying and what they are earning. The other caveat here is that HYT and HIX also have futures contracts and/or interest rate swaps to hedge against interest rate risks. That can help contribute to capital gains to fund their distributions. That said, for fixed-income funds, generally, we want to see NII coverage at or over 100%.

HYI’s Portfolio

HYI’s portfolio is overwhelmingly comprised of corporate bonds, as its investment goal states. There are some government issues, but it isn’t a significantly important part of their portfolio overall. The fund’s turnover rate is fairly high, with their last semi-annual report showing a 62% rate. The average over the last five years comes in at 63.6%. The fund’s weighted average life of the portfolio comes to 5.04 years and has an effective duration of 3.48 years. The fund has not seen a material change from the prior update in either of those figures.

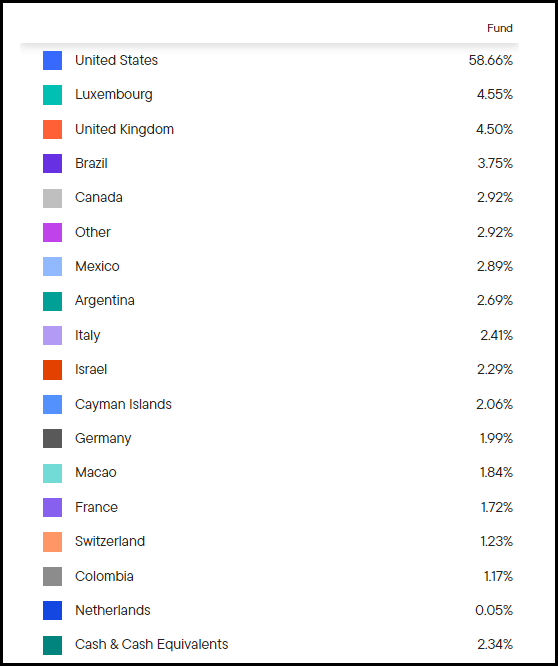

The fund also takes a more global approach, with just over 40% of its holdings to companies/governments outside of the U.S. Despite the fairly high turnover, the fund’s geographic breakdown hasn’t changed materially since our prior update. At that time, U.S. exposure was at around 60%, and it was followed in the same order by Luxembourg, the United Kingdom and Brazil as well.

HYI Geographic Allocation (Western Asset)

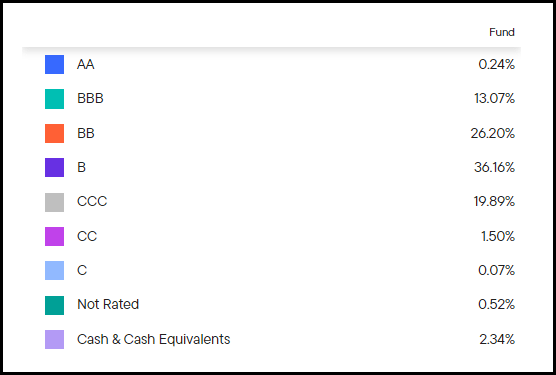

Despite the high yield in its name and focus primarily on below-investment-grade debt, the fund does have a small sleeve that is classified as investment-grade. Perhaps this is to help compensate the lower end of the quality spectrum that they are carrying, primarily the rather large CCC and lower weightings that come in at ~20% of the fund’s weighting.

That being said, similar to the fund’s geographic weighting, there wasn’t a material change in any of the credit quality sleeves here, either. If anything, it saw its quality inch up just a bit as CCC weighting declined a couple of points.

HYI Portfolio Credit Quality (Western Asset)

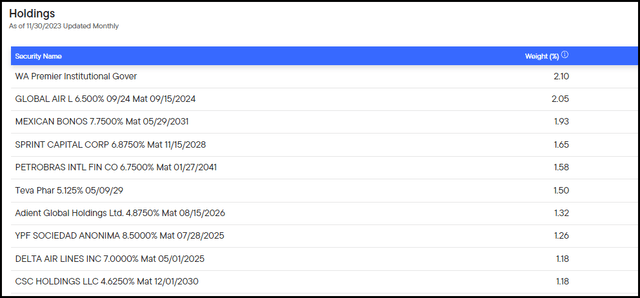

One common characteristic of most high-yield funds is having higher diversification. That’s whether through geographic allocation or sector allocation, which HYI does offer a fair bit of various sector exposure as well to help out its diversification. However, one of the primary characteristics I’ve seen in this space is having hundreds of holdings. For HYI, it is no different, and CEFConnect puts the number of holdings at 260.

Further, while funds can have hundreds or thousands of holdings, they could still ultimately be fairly narrowly focused if the top holdings command an overly large allocation to a select few names. That isn’t the case for HYI, though, and I’d consider each of these weightings to still allow for adequate diversification across most of HYI’s portfolio. The largest position here is actually a 2.1% weighting to a cash-equivalent holding.

HYI Top Holdings (Western Asset)

Conclusion

HYI has seen its discount narrow, and given the term structure of this fund and the anticipation of liquidating in less than two years, it could start to play a more important role in the fund. The closer we get to that date, the more important it can be to pay attention. Particularly if the fund presents a vote to go perpetual, or even in this case, investors get input on whether the fund should extend its termination date.

Overall, the fund sports a rather strong yield that is competitive with its leveraged peers. In fact, it can even out-yield some of its leveraged peers if you factor in actual coverage levels. Without leverage, the fund should be relatively less volatile and risky. Though it’s still a high-yield focused fund with material exposure to CCC rated and lower debt, which helps drive the yield it can pay higher.

No comments:

Post a Comment